- Sustainability

- Sustainable Finance

- Product Responsibility

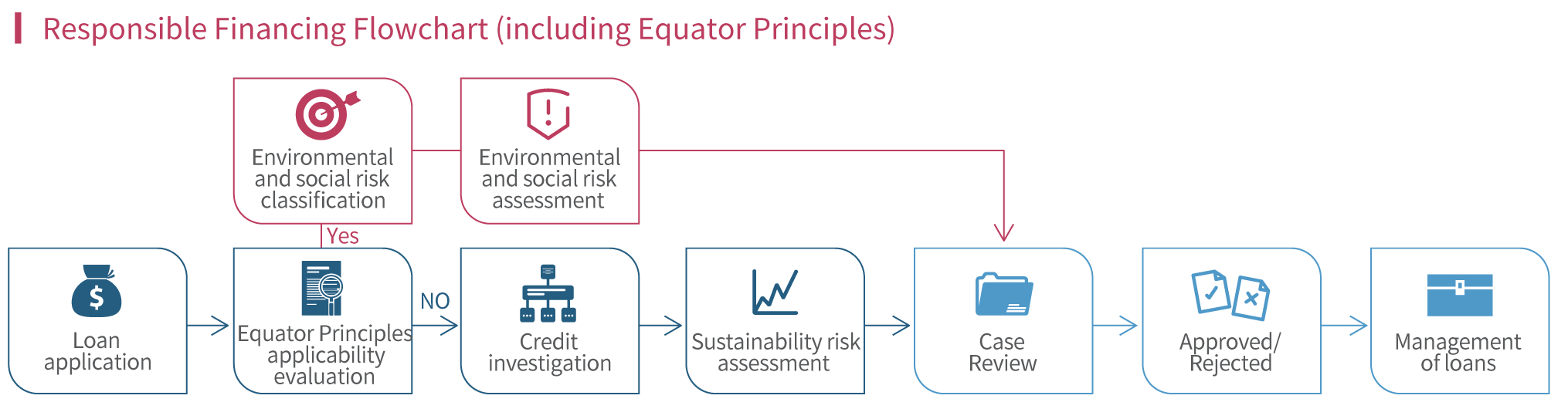

In order to implement sustainable financial risk management, Yuanta Bank follows the “Sustainable Finance Guidelines"to coordinate with the adjustment of relevant business practices and internal processes, incorporate sustainable financial risk management into the credit business review and decision making process, and require the completion of sustainable financial assessment for credit business, stipulating that credit business should carefully assess whether there are potential risks of environmental and social hazards in the counterparty or transaction content, and conduct KYC (know your customer) and CDD (customer due diligence) process to understand the reputation, business content, financial status, management capability and regulatory compliance of the credit counterparty, international sustainability index scores, and the presence of negative ESG issues to ensure risk control.

Yuanta Bank signed the Equator Principles and became a member bank of the Equator Principles Association. In November 2020, Yuanta Bank completed the formulation of the “Guidelines for Managing Equator Principles Financing Cases”and related operational procedures. The Equator Principles were officially implemented on June 1 ,2021. When providing customer credit or related financial advisory services, business units are required to confirm whether the Equator Principles are applied in their dealings. If applicable conditions are met and the case is evaluated as a medium to high environmental and social risk case, the grantor shall be required to commission an independent third party to perform the environmental and social risk assessment and issue an assessment report as a reference basis for the environmental and social risk assessment of the case.

The “Task Force on Environmental and Social Risk" was established by Yuanta Bank to evaluate, review, and monitor the environmental and social risks of lending cases. A classification is employed to manage environmental and social risks of large-scale project financing cases. The environmental and social impacts that the projects may cause in terms of climate change, greenhouse gas emissions, and important stakeholders are carefully evaluated under the framework of Equator Principles 4.0. Adequate environmental and social risk monitoring reports and improvement action plans should be obtained when relevant conditions apply to ensure compliance with the Equator Principles and to raise the awareness of environmental protection and social responsibility among our customers.

Three project financing cases were reviewed according to the Equator Principles. However, all three cases were declined. The first case was declined because of the concern that the solid recovered fuel recycling process conducted by the waste supplier may result in unsatisfactory outcomes for the power plant, in which case, the performance of the power plant may be compromised and highly polluting emissions may increase. The second case was declined because of the lending period and the fact that the arranger does not adopt the Equator Principles; moreover, the client was unable to provide an environmental and social due diligence report issued by a third-party agency. The third case was declined because although the project is not located within the area of an important wetland, the location is only 1.5 km away from the closest important wetland and may have impacts on the waterbird habitat in the area; further observation and survey is needed to determine its environmental and social impacts. The total amount of loans for these three cases is NT$1.9 billion.

In response to Taiwan’s Program for Promoting Six Core Strategic Industries, Yuanta Bank has approved loans for green power and renewable energy industries and supported relevant industries that endeavor to fulfill environmental protection and pollution control requirements through resource integration and green innovative material research and development. With such actions, Yuanta is doing our part in helping Taiwanese industries achieve low-carbon sustainable transformation.

Unit:NT$ thousand| Categories | 2021 | 2022 | ||||

|---|---|---|---|---|---|---|

| Loan Amount | Total Lending Amount<(Note) | Proportion of Total Lending (%) |

Loan Amount | Total Lending Amount(Note) | Proportion of Total Lending (%) |

|

| Green loans, social loans, sustainable loans*Note1 | $138,927,039 | $494,985,834 | 28.07 | $171,124,052 | $639,585,085 | 26.76 |

| Sustainability-linked corporate loans *Note2 | $4,030,000 | 0.81 | $38,151,584 | 5.97 | ||

| Total | $142,957,039 | 28.88 | $209,275,636 | 32.73 | ||

- This involves the green power and renewable energy industry as well as related infrastructure, and uses resource integration and innovative green material-related R&D to increase industries’ demands for environmental protection equipment, lower water consumption, diminish the harmful impact of waste on the environment, prevent pollution and engage in related construction, build low-carbon buildings, and develop/carry out transportation-related industries and projects.

- Set ESG goals for companies, where rewards such as money and low rates are given when they achieve these goals.

- In this table, the total lending amount and loan amount are defined as the amount of money from new cases in the current year.

In accordance with the spirit of the “Sustainable Finance Guidelines”, Yuanta Bank encourages companies to implement sustainable practices to promote Sustainability-Linked Loan. With our employees taking the initiative to negotiate each lending case, companies will understand the spirits of ESG. When these companies show proactive actions in either the environmental, social, or governance aspect, we will offer favorable terms in interests or rates with the hope of supporting companies that promote sustainable development of society with favorable lending terms. This year, we focused on advocating internal ESG guidelines and strategies in each company. A total of 22 cases were approved and the sum total of the balance of loans is NT$18.5 billion; comparing to 2021, the number of approved cases increased by 15 and the balance of loans increased by NT$12.7 billion. In the future, Yuanta Bank will review the achievement of its relevant ESG targets and provide preferential reductions in interest and fee rates. It will also continue to refine relevant business processes and actively promote sustainability-linked businesses and products, inviting customers to move together towards a sustainable path and enhance the positive impact on the environment and society.

| Categories | 2021 | 2022 | ||||

|---|---|---|---|---|---|---|

| Loan Amount | Total Lending Amount | Proportion of Total Lending (%) |

Loan Amount (NT$ thousand) |

Total Lending Amount | Proportion of Total Lending (%) |

|

| Sustainable SME loans*Note1 | $6,152,740 | $161,676,589 | 3.81 | $18,138,108 | $125,902,557 | 14.41 |

- Companies that use the loans for “green expenditure” and those that engage in renewable energy power generation, cleaning technology, and energy efficiency are companies belonging to the ESG industry.

- In this table, the total lending amount and loan amount are defined as the amount of money from new cases in the current year.

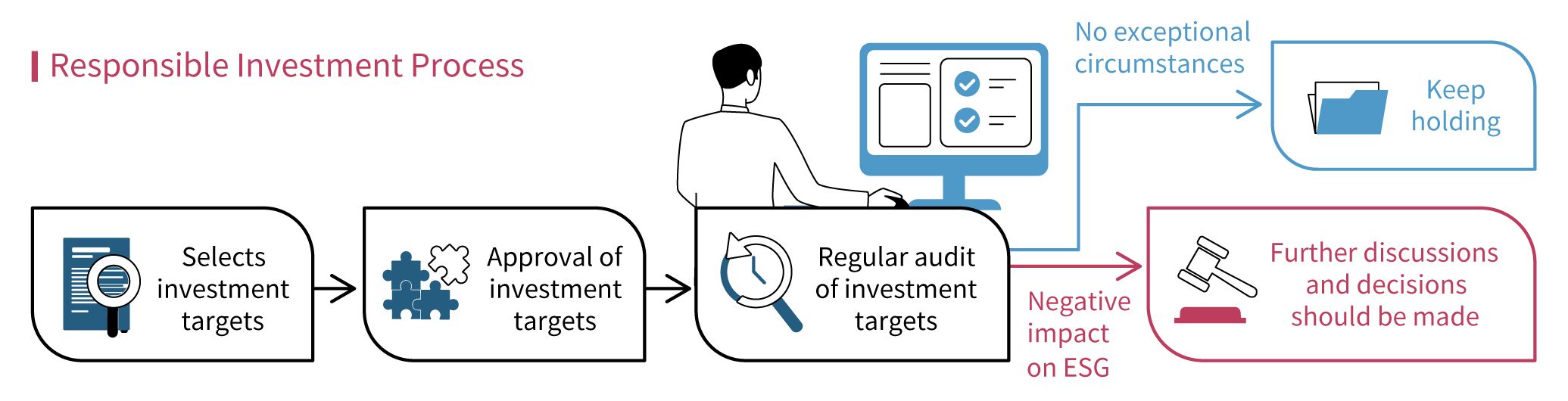

Each subsidiary of Yuanta Financial Holdings incorporates ESG-related screening criteria into investment-related regulations according to its business type and establishes internal mechanisms to implement the spirit of responsible investment. Yuanta Securities, Yuanta Bank, and Yuanta Life, in order to make the best use of the sustainable development of the financial industry, select medium- and long-term investment targets through the following risk assessment framework, and consider the environmental and social performance of the investment targets when selecting investment targets, so as to reduce environmental or social risks caused by the investment and support the development of sustainable enterprises with capital.The total responsible investments of Yuanta Securities, Yuanta Bank, and Yuanta Life this year were NT$56.64 billion.

| Excluded Items | Companies that are prohibited from operating under the Sustainable Finance Guidelines. |

|---|---|

| Supported Projects | We actively support companies that have a positive impact on society and the environment as defined by the Sustainable Finance Guidelines. |

| Investment Projects Should Be Avoided | The Company should avoid investing in controversial companies mentioned in the Sustainable Finance Guidelines. If the investment is still assessed to have medium- to long-term investment value, the Company must state the reasons for the exceptional investment, and then report the reasons to each subsidiary at the approval level after all members of the investment decision meeting have agreed, and the reasons must be signed by the Risk Management Department staff in attendance. |

| Specific Industries | Industries stated in the Yuanta Financial Holdings Industry-Specific Environmental and Social Risk Management Rules should include an evaluation using the Industry-Specific Environmental and Social Risk Management Checklist. |

| Pre-Investment and Post-Investment Review | Pre-investment review is based on the “Sustainable Finance Assessment Form” and the“Industry-Specific Environmental and Social Risk Management Checklist,” and we also regularly review the sustainable development of investment counterparties for post-investment review to ensure that they are sustainable. |

The Company has established engagement and voting guidelines this year. The goal is to prompt the invested companies to improve their corporate governance quality and promote overall benign development in society and the industry through credit issuing and other lending interactions. Crucial ESG issues such as climate change and biodiversity have been listed, so that all subsidiaries can establish relevant evaluation mechanisms or indicators. Companies with low ESG indicator scores will be engaged first. If these companies do not address or improve issues in question, the Group may limit the amount of funds available for them. Moreover, the Group does not rule out the possibility of expressing its appeal jointly with other financial institutions, industry associations, and/or government organizations. The Group has established a decision-making process in favor of the shareholder resolutions that allows us to participate in the invested company’s decision making through voting. If the discussion topic involves a major ESG issue or an ESG issue with potential major risks, the Group may discuss the topic with the invested company’s management before shareholder meetings; if necessary, the Group may vote against the topic or waive the right to vote.

The Group also communicates with the management of invested companies through telephone calls, mails, or meetings (such as institutional investors conferences and shareholders meetings). When an invested company violates ESG principles on specific issues and damages the rights of the Company’s customers or beneficiaries, the Company will exercise its voting rights or other shareholders’ rights to express its demands to the management of the invested company and further influence the conduct of the invested company.

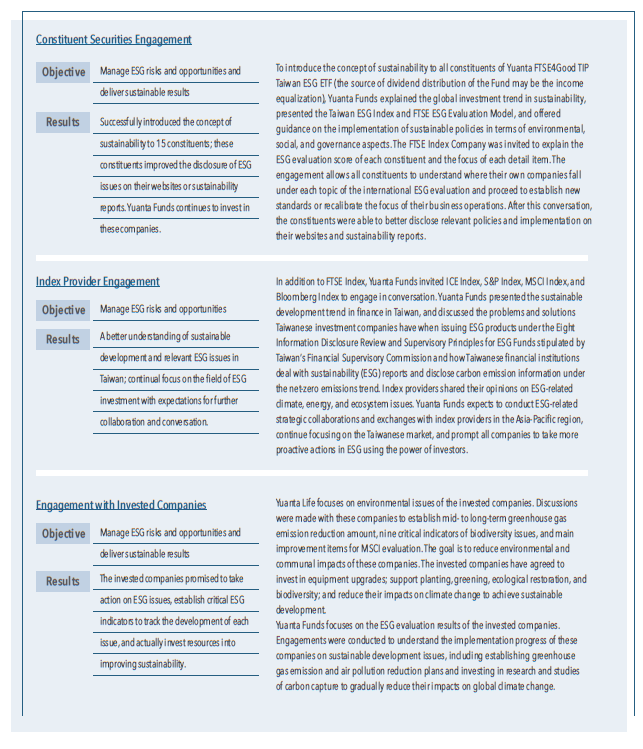

Yuanta Life and Yuanta Funds have conducted engagements as institutional investors, respectively, with invested companies and relevant partners to help them establish relevant response strategies, improvement plans, and future goals on major environmental issues. Examples of such engagements are as follows:

| Investing Company | Bond Name | Bond Code | Investment Amount in 2023 (Unit: NT$ 100 million) |

Description |

|---|---|---|---|---|

| Yuanta Bank | TSMC 1st Unsecured Corporate Bond in 2023 - Tranche A | B618DD | 8 | Taipei Exchange (TPEx) Green Bond |

| TSMC 2nd Unsecured Corporate Bond in 2023 - Tranche A | B618DG | 4.5 | TPEx Green Bond | |

| 3rd Senior Financial Debt of E.SUN Bank in 2022 | G102B8 | 10 | TPEx Green Bond | |

| 1st Senior Unsecured Financial Debenture of E.SUN Bank in 2023 | G102BA | 2 | TPEx Social Bond | |

| Hua Nan Commercial Bank 2nd Issue of Senior Unsecured Financial Bonds in 2021 | G189AV | 1 | TPEx Green Bond | |

| The 2nd Issuance of Senior Unsecured Financial Debentures of Taiwan Cooperative Bank in 2023 | G12446 | 2 | TPEx Sustainability Bond | |

| First Bank 1st Issue of Senior Unsecured Financial Debentures in 2023 | G159A8 | 2 | TPEx Sustainability Bond | |

| Chang Hwa Bank 1st Issue of Senior Unsecured Financial Debentures in 2023 | G14940 | 2 | TPEx Sustainability Bond | |

| Far Eastone Telecommunications Co., Ltd. 1st Domestic Unsecured Corporate Bond - A Issuance in 2023 | B94656 | 0.5 | TPEx Social Bond | |

| Far Eastone Telecommunications Co., Ltd. 2nd Domestic Unsecured Corporate Bond in 2023 | B94658 | 5 | TPEx Social Bond | |

| Yuanta Securities | TSMC 2nd Unsecured Corporate Bond in 2023 - Tranche A | B618DG | 3 | TPEx Green Bond |

| CHIMEI Corporation 1st Unsecured Corporate Bond Issue in 2023 | B98413 | 5 | TPEx Sustainability Bond | |

| Yuanta Life | Far Eastern New Century Corporation 2nd Unsecured Corporate Bond Issue in 2023 | B50175 | 5 | TPEx Green Bond |

| TSMC 1st Unsecured Corporate Bond in 2023 - Tranche C | B618DF | 15 | TPEx Green Bond | |

| Credit Agricole Corporate and Investment Bank, Taipei Branch 1st Issue of Senior Unsecured Financial Bond in 2023 | G14005 | 2 | TPEx Green Bond | |

| BNP Paribas, Taipei Branch 2023-1 Senior Unsecured Notes | G13806 | 3 | TPEx Green Bond | |

| 1st Senior Unsecured Financial Debenture of E.SUN Bank in 2023 | G102BA | 3 | TPEx Social Bond | |

| Total | 73 | |||

元大金控

元大金控