Yuanta Financial Holding Company regards influence as a core element driving corporate sustainability and is committed to creating long-term value for stakeholders and monetizing the impact of specific material topics on stakeholders.

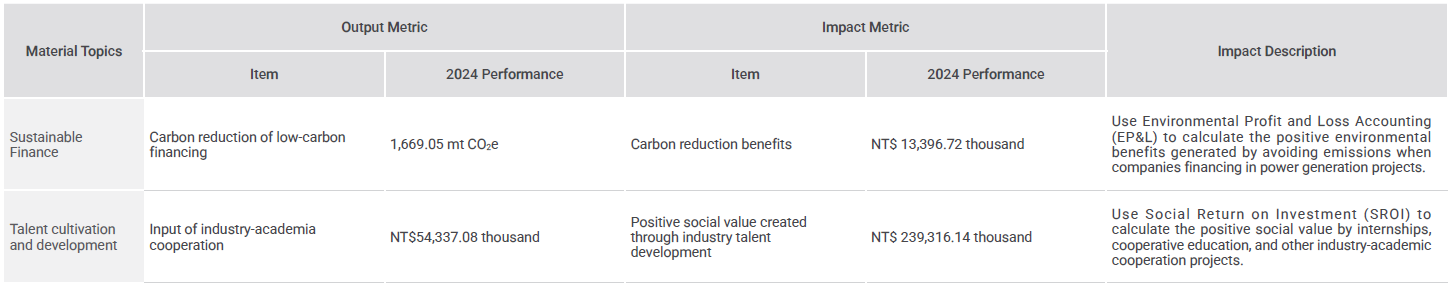

In 2024, the Company used the Environmental Profit and Loss Accounting (EP&L) to calculate the carbon reduction and carbon reduction benefits brought about by power generation project financing, and measured the quantitative output and impact of “sustainable finance.” In addition, we also used the Social Return on Investment (SROI) methodology to measure the positive social value created by the Group’s investment in “talent cultivation and development.”

By monetizing “sustainable finance” and “talent cultivation and development,” the Company is able to measure the impact of various operational activities on society and continue to bring positive benefits to society.

元大金控

元大金控