- Sustainability

- Sustainable Finance

- Product Responsibility

In order to implement sustainable financial risk management, Yuanta Bank follows the “Sustainable Finance Guidelines"to incorporate sustainable financial risk management into the lending business review and decision making process. It also requires the completion of sustainable financial assessment for its lending business, stipulating that the lending business should carefully assess whether there are potential risks of environmental and social hazards in the counterparty or transaction content, and should incorporate ESG factors into KYC (know your customer) and CDD (customer due diligence) investigation processes to understand the regulatory compliance of the lending counterparty, international sustainability index scores, and the presence of negative ESG issues to ensure risk control.

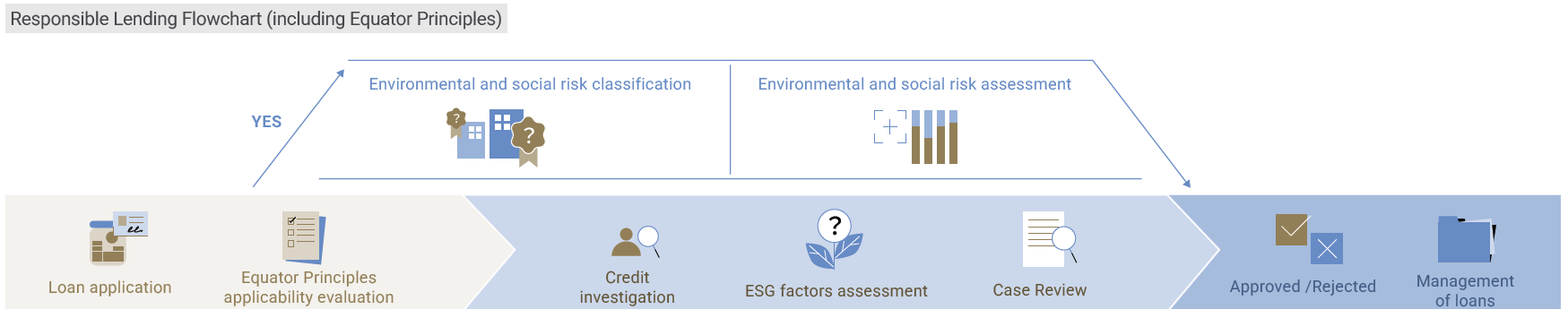

Yuanta Bank signed the Equator Principles and became a member bank of the Equator Principles Association in 2020. Yuanta Bank completed the formulation of the “Guidelines for Managing Equator Principles Financing Cases” and related operational procedures in the same year. The Equator Principles were officially implemented on June 1 ,2021.

When providing customer credit or related financial advisory services, if the transactions meet the conditions for applying the Equator Principles and are assessed as cases with medium to high environmental and social risks, the credit counterparties will be required to commission an independent third-party organization to conduct environmental and social risk assessments, and issue an assessment report as a reference basis for the environmental and social risk assessment of the case.

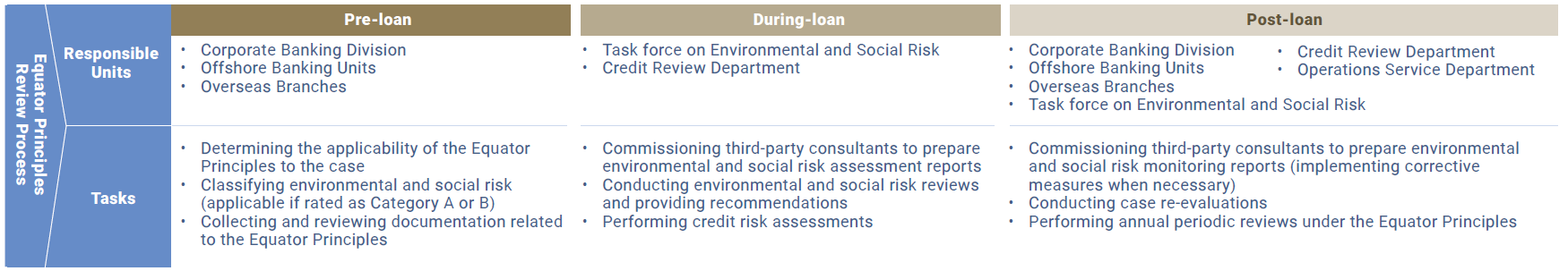

The "Task Force on Environmental and Social Risk" was established by Yuanta Bank to evaluate, review, and monitor the environmental and social risks of lending cases. A classification is employed to manage environmental and social risks of large-scale project financing cases. The environmental and social impacts that the projects may cause in terms of climate change, greenhouse gas emissions, and important stakeholders are carefully evaluated under the framework of Equator Principles 4.0. At the environmental and social risk assessment stage, for credit cases rated as Category A or B, an environmental and social risk assessment report shall be completed. If the report lists post-loan monitoring conditions, the borrower shall, as required, commission an independent third-party organization to conduct environmental and social risk monitoring on a regular basis (at least once a year) and issue an "Environmental and Social Risk Monitoring Report." Adequate environmental and social risk monitoring reports and improvement action plans should be obtained when relevant conditions apply to ensure compliance with the Equator Principles and to raise the awareness of environmental protection and social responsibility among our customers.

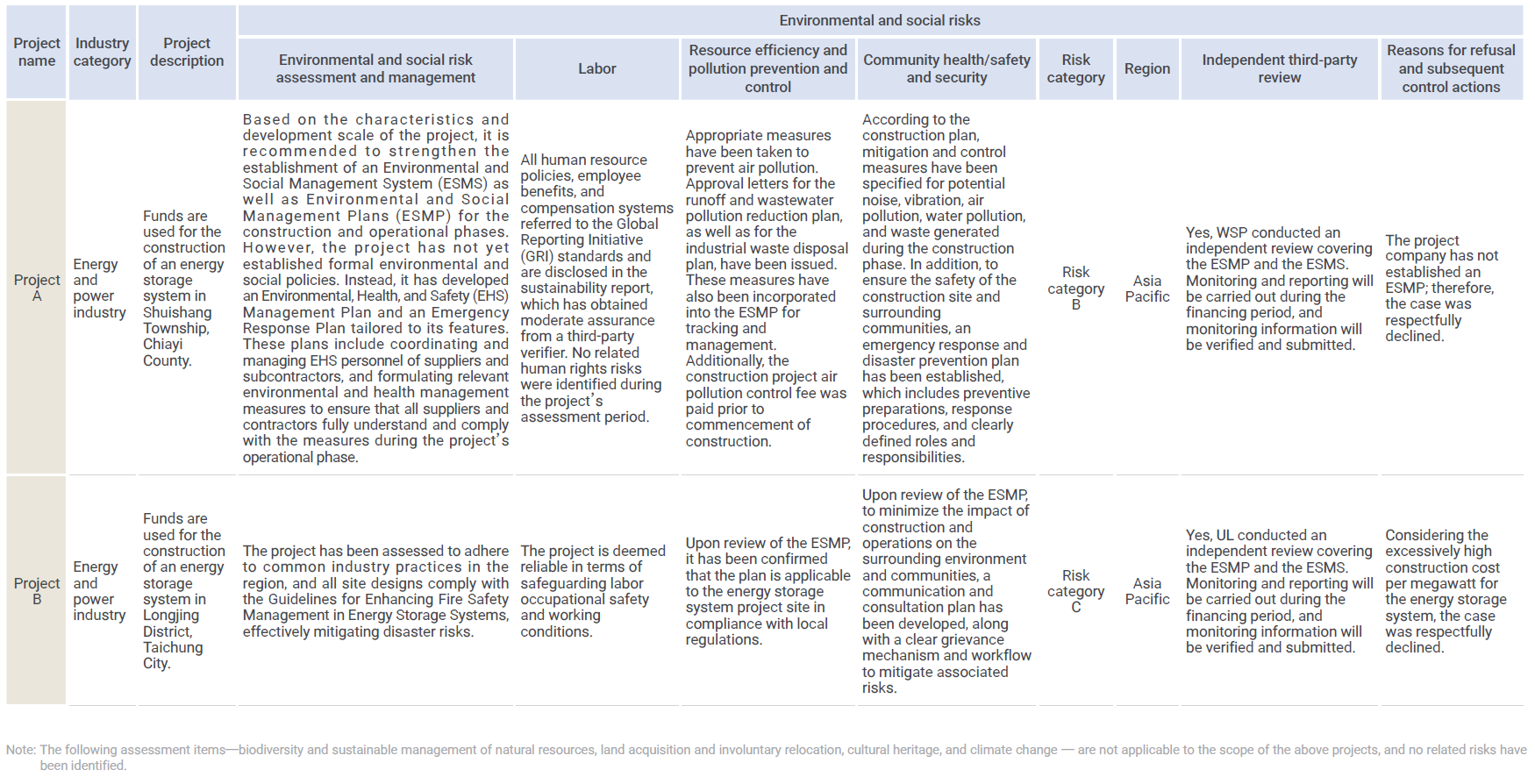

Four project financing cases were reviewed according to the Equator Principles. However, all cases were declined, totaling NT$1.2 billion of the rejected cases. Two cases were respectfully declined during the initial assessment stage, and therefore no related documentation was collected. Assessment summaries for the remaining two cases are as follows:

Yuanta Bank is committed to adhering to the United Nations Principles for Responsible Banking (PRB). Through the implementation of responsible lending processes, it actively supports projects and enterprises that have a positive impact on ESG issues. Additionally, by offering sustainable financial products and services, Yuanta Bank leads its borrowers in generating positive environmental and social outcomes. Yuanta Bank's compliance with the Responsible Banking Principles in 2024 is as follows:

| Yuanta Bank's compliance with the Responsible Banking Principles in 2024 | |

|---|---|

| Principle 1: Alignment We will align our business strategy to be consistent with and contribute to individuals' needs and society's goals, as expressed in the Sustainable Development Goals, the Paris Climate Agreement and relevant national and regional frameworks. |

Yuanta Bank, a wholly owned subsidiary of Yuanta Financial Holdings, was established with the approval of the Ministry of Finance on January 14, 1992. Over the decades, it has grown into a regional bank in the Asia-Pacific region, committed to providing comprehensive financial services. As of December 31, 2024, Yuanta Bank has 4,852 employees and a capital of approximately NT$79.953 billion with 149 branch locations in Taiwan and three overseas branches—bank branch in Hong Kong, bank subsidiary in the Philippines, and bank subsidiary in South Korea. Through cooperation among its domestic and overseas locations, the bank offers customers diverse and cross-border financial services. Yuanta Bank upholds the Group's commitment to incorporate the spirit of corporate sustainable development into business planning and operations. In support of the United Nations' Sustainable Development Goals (SDGs), the bank is dedicated to raising clients' awareness of climate change in hope of collaborating with partner enterprises in fulfilling social responsibilities. While pursuing business growth and profitability, the bank remains focused on environmental protection, social welfare, and corporate governance. It also supports green industries and low-carbon transitions, and promotes human rights protection, and sustainable supply chains. To realize the Group's net-zero pledge, Yuanta Bank aligns itself with the international Paris Agreement and the blueprint for Taiwan's Pathway to Net-Zero Emissions in 2050. The bank is fully committed to achieving the regulatory goal of net-zero emissions by 2050 as a long-term sustainability objective. It has established emissions reduction pathways and is actively adjusting its business strategies to reinforce its net-zero commitments. |

| Principle 2: Impact & Target

Setting

We will continuously increase our positive impacts while reducing the negative impacts on, and managing the risks to, people and environment resulting from our activities, products and services. To this end, we will set and publish targets where we can have the most significant impacts. |

In response to international sustainability trends and in alignment with government policies on net-zero transition and energy transition, Yuanta Bank is channeling funds into the development of green technology and innovation, guiding enterprises toward a low-carbon economy and sustainable development. In 2024, the balance of green loans and sustainability-linked loans reached NT$89.212 billion, accounting for 13.37% of the bank's total credit portfolio. Yuanta Bank is committed to fitting its financing activities with the goals and timeline of the Paris Agreement. By measuring the carbon emissions of its asset portfolio and investing in sustainable and green industries, the bank is working together in the efforts to keep global warming at 1.5° C. In 2024, following the Global GHG Accounting and Reporting Standard for the Financial Industry published by PCAF, Yuanta Bank conducted an emissions audit across asset classes covering corporate loans, equity and corporate bonds, and project finance for power generation. The total financed emissions amounted to 13,102,322.93 tCO2e. In addition, based on the Total Impact Measurement and Management (TIMM) methodology, the carbon reduction benefits of its low-carbon financing were calculated, with a performance result of 13,396.72 thousand NT dollars. Yuanta Bank continues to align with sustainability trends in the market, and the KPI criteria of the sustainable development strategy blueprint set by Yuanta Financial Holdings, actively developing ESG-related products and services and setting targets for sustainable lending balances. |

| Principle 3: Clients & Customers We will work responsibly with our clients and our customers to encourage sustainable practices and enable economic activities that create shared prosperity for current and future generations. |

Yuanta Bank offers diverse and professional sustainable financial services, dedicated to helping clients transition to a low-carbon economy and navigate this extraordinary period of transformation. Yuanta Bank also participates in the Group's joint engagement efforts, practicing engagement actions concerning stewardship for sustainable finance. As a founding member of the "Coalition of Movers and Shakers on Sustainable Finance," Yuanta Financial Holdings, along with Yuanta Bank, works to guide clients and leverage peer influence. By the end of 2025, the bank aims to engage with more than half of the Taiwan enterprises in its major financing and investment portfolios which are in high carbon emissions industries. The major goal of these engagements is to encourage the enterprises to set targets for achieving net-zero emissions by 2050. Yuanta Bank offers a variety of sustainability-themed products for consumers to select from to promote green consumption and, prior to granting credit, reviews whether collateral properties are located in areas with high environmental risk— demonstrating the bank's financial influence to drive industries and society toward sustainable development.

|

| Principle 4: Stakeholders We will proactively and responsibly consult, engage and partner with relevant stakeholders to achieve society's goals. |

Yuanta Bank, in line with Yuanta Financial Holdings' adoption of the AA1000 Stakeholder Engagement Standard (AA1000 SES), has identified eight major categories of stakeholders, including shareholders/investors/creditors, government agencies, current employees, potential employees, customers and debtors, media, communities, and suppliers. By building various communication channels, the bank engages in dialogue with stakeholders to understand their concerns. These insights are then analyzed, so adjustments to relevant measures can be made to better match stakeholder expectations. To implement the Group's sustainable development policies and strategies, Yuanta Financial Holdings has established the Corporate Sustainability Office under its Sustainable Development Committee. Composed of senior executives and staff from relevant departments of Yuanta Financial Holdings and the Group's subsidiaries, this office also includes participation from independent directors. In addition to driving and coordinating daily sustainability initiatives, quarterly meetings are held to build consensus and review progress around key issues, such as the Group's sustainability strategy blueprint and goals, implementation status at each subsidiary, and stakeholder concerns. Furthermore, suggestions provided by independent directors during meetings help subsidiaries examine and improve their current ESG practices. This collaborative effort aims to enhance recognition from reputable domestic and international rating agencies and stakeholders, while also laying a solid foundation for future sustainable developments |

| Principle 5: Governance & Culture We will implement our commitment to these Principles through effective governance and a culture of responsible banking. |

|

| Principle 6: Transparency & Accountability We will periodically review our individual and collective implementation of these Principles and be transparent about and accountable for our positive and negative impacts and our contribution to society's goals. |

Yuanta Bank evidences its commitment to the Principles for Responsible Banking (PRB) and its influence by regularly evaluating the implementation of these principles and disclosing relevant information publicly. This report summarizes the bank's spirit and impact in the management of financial products and services with a sustainability focus. Key execution progress is outlined as follows:

|

Yuanta Bank follows the spirit of the "Sustainable Finance Guidelines" and provides sustainable products and services to corporate clients, aligning with both domestic and international advocacy principles and guidelines through a rolling review mechanism. The bank evaluates the achievement of ESG indicators and refines its business processes to better meet clients’ operational goals and transformation plans, catering to their needs for green and transition financing.

In response to the goal of net zero transition set by the government, Yuanta Bank has been actively promoting Six Core Strategic Industries by approving loans for green power and renewable energy industries and supporting relevant industries that endeavor to fulfill environmental protection and pollution control requirements through resource integration and green innovative material research and development. With such actions, Yuanta Bank receives the "Excellent Bank for Offering Loans to Six Core Strategic Industries" award.

Unit:NT$ thousand| Categories | 2023 | 2024 | ||||

|---|---|---|---|---|---|---|

| Loan Amount | Total Lending Amount(Note) | Proportion of Total Lending (%) |

Loan Amount | Total Lending Amount(Note) | Proportion of Total Lending (%) |

|

| Sustainable lending*Note1 | $200,709,500 | $904,895,894 | 22.18 | $238,825,248 | $1,004,878,844 | 23.77 |

| Sustainability-Linked loan*Note2 | $51,980,335 | 5.74 | $580,859,840 | 8.05 | ||

| Sustainable SME loansN*Note2 | $25,449,903 | 2.81 | $48,576,239 | 4.83 | ||

| Total | 278,139,738 | 30.73 | 368,261,327 | 36.65 | ||

- Sustainable lending includes green loans, social loans, and sustainable loans. The industries or projects financed include: the green power and renewable energy industry as well as related infrastructure, and uses resource integration and innovative green material related R&D to increase industries’ demands for environmental protection equipment, lower water consumption, diminish the harmful impact of waste on the environment, prevent pollution and engage in related construction, build low-carbon buildings, and develop/carry out transportation-related industries and projects.

- Taking reference from the GLPs issued by the LMA, LSTA, and APLMA, we engage in industry specialization discussions with businesses to establish sustainability performance targets (SPTs). These targets are then measured using pre-defined KPIs, and we subsequently track whether the business achieve these goals. If the targets are met, predetermined interest rate discounts are provided.

- The loan programs are designed based on the Sustainable Linked Loan (SLL) principles, as we consistently negotiate sustainability-related indicators with clients. If the relevant conditions are met, the preferential interest rates will be provided as an incentive.

- Companies that use the loans for "green expenditure" and those that engage in renewable energy power generation, cleaning technology, and energy efficiency are companies belonging to the ESG industry.

- In this table, the total lending amount and loan amount are defined as the amount of money from newly approved cases in the current year.

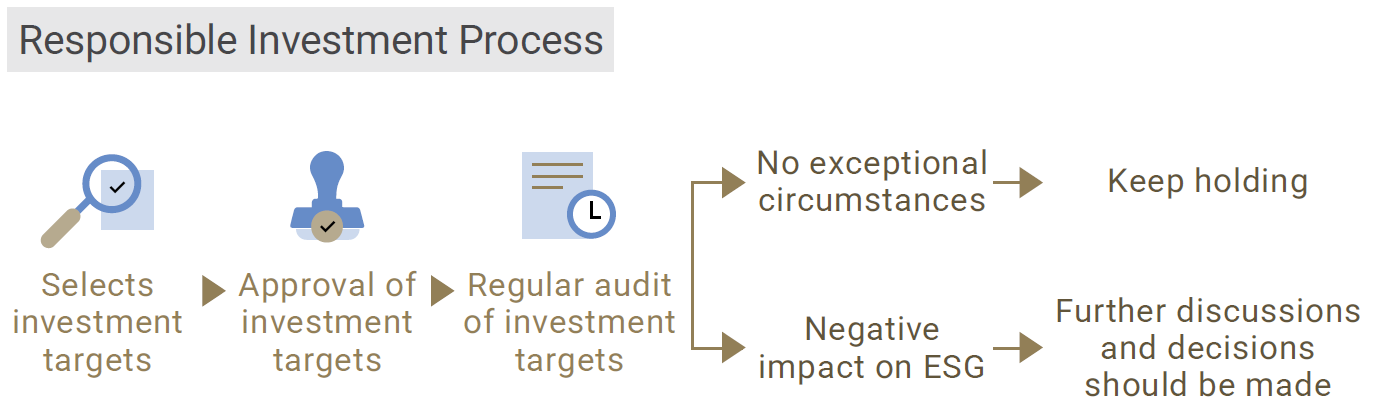

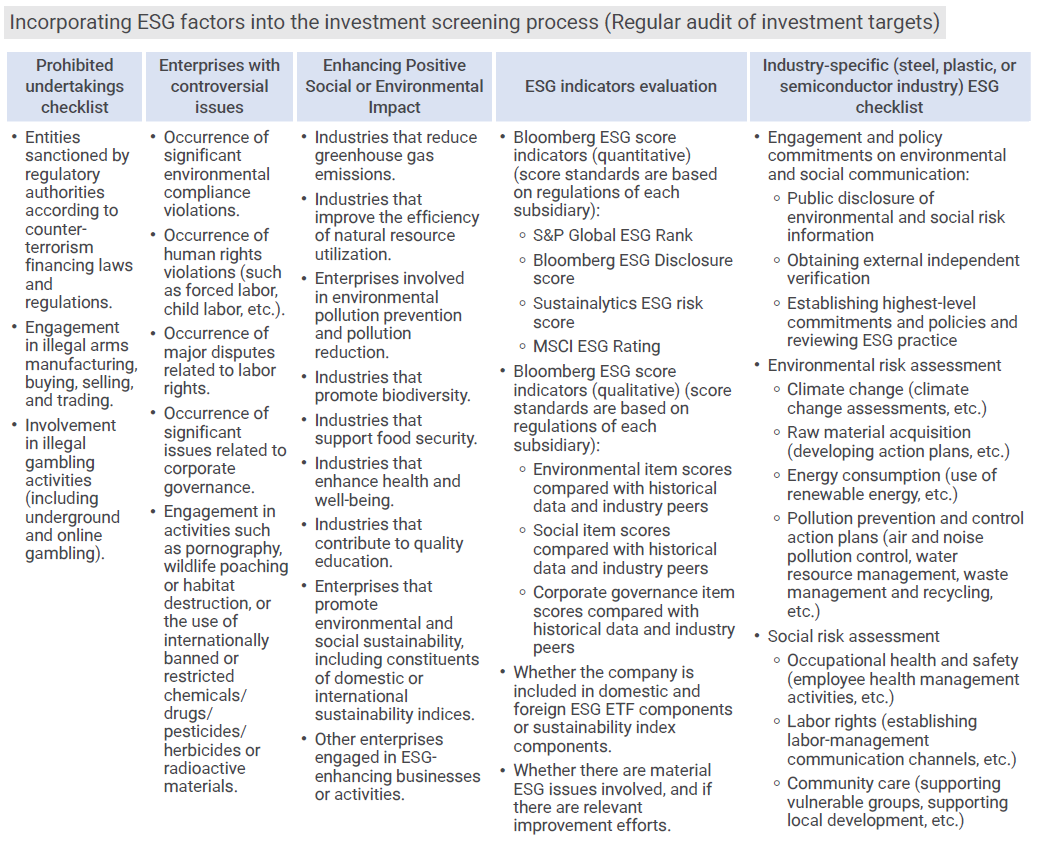

Each subsidiary of Yuanta Financial Holdings incorporates ESG-related screening criteria into investment-related regulations according to its business type and establishes internal mechanisms to implement the spirit of responsible investment. Yuanta Securities, Yuanta Bank, and Yuanta Life, in order to make the best use of the sustainable development of the financial industry, incorporates the assessment of ESG factors into the selection of medium- and long-term investment targets, and considers the environmental and social performance when selecting investment targets, so as to reduce environmental or social risks caused by the investment and support the development of sustainable enterprises with capital.

Yuanta Securities selects investment targets in proprietary trading, and if the target is a medium- to long-term securities investment, the trading staff of the Securities and Investment Department should fill out the ESG checklist, perform the ESG audit operation process, and have the ESG assessment report approved by the department head of the Securities and Investment Department before executing the transaction. If the target is a bond, an ESG checklist is completed by the bond trader and signed by the senior executive of the bond department to ensure the quality of ESG audit operations. In addition, the Group follows the "Guidelines for Sustainable Economic Activities Recognition" issued by the Financial Supervisory Commission, incorporating relevant industries into investment decisions or target selections.

The ESG audit criteria is formulated with reference to ESG-related indicators from domestic and international databases. The audit process is then conducted by Yuanta Securities’ internal staff through the evaluation of relevant indicators and information including Bloomberg ESG indicator scores of investees, listed company websites, exchange websites, TDCC website and Bloomberg information. Furthermore, in the business of regular fixed-amount purchases of Taiwan stocks, Yuanta Securities selects investment targets based on a medium- to long-term investment principle, while also considering whether the targets are constituent stocks of the Taiwan Sustainability Index, in the hope of guiding customers to select companies with good ESG performance.

The Company has established engagement and voting guidelines this year. The goal is to prompt the invested companies to improve their corporate governance quality and promote overall positive development towards society and the industry through credit issuing and other lending interactions. Crucial ESG issues such as climate change and biodiversity have been listed, so that all subsidiaries can establish relevant evaluation mechanisms or indicators. Companies with low ESG indicator scores will be engaged first. If these companies do not address or improve issues in question, the Group may limit the amount of funds available for them. Moreover, the Group does not rule out the possibility of expressing its appeal jointly with other financial institutions, industry associations, and/or government organizations. The Group has established a decision-making process in favor of the shareholder resolutions that allows us to participate in the invested company’s decision making through voting. If the discussion topic involves a major ESG issue or an ESG issue with potential major risks, the Group may discuss the topic with the invested company’s management before shareholder meetings; if necessary, the Group may vote against the topic or waive the right to vote.

The Group also communicates with invested companies through telephone calls, e-mails, or meetings (such as institutional investors conferences and shareholders meetings). When an invested company violates ESG principles on specific issues and damages the rights of the Company’s customers or beneficiaries, the Company will exercise its voting rights or other shareholders’ rights to express its demands to the management of the invested company and further influence the conduct of the invested company. The total responsible investments of Yuanta Securities, Yuanta Bank, and Yuanta Life for the year 2023 were NT$66.77 billion.

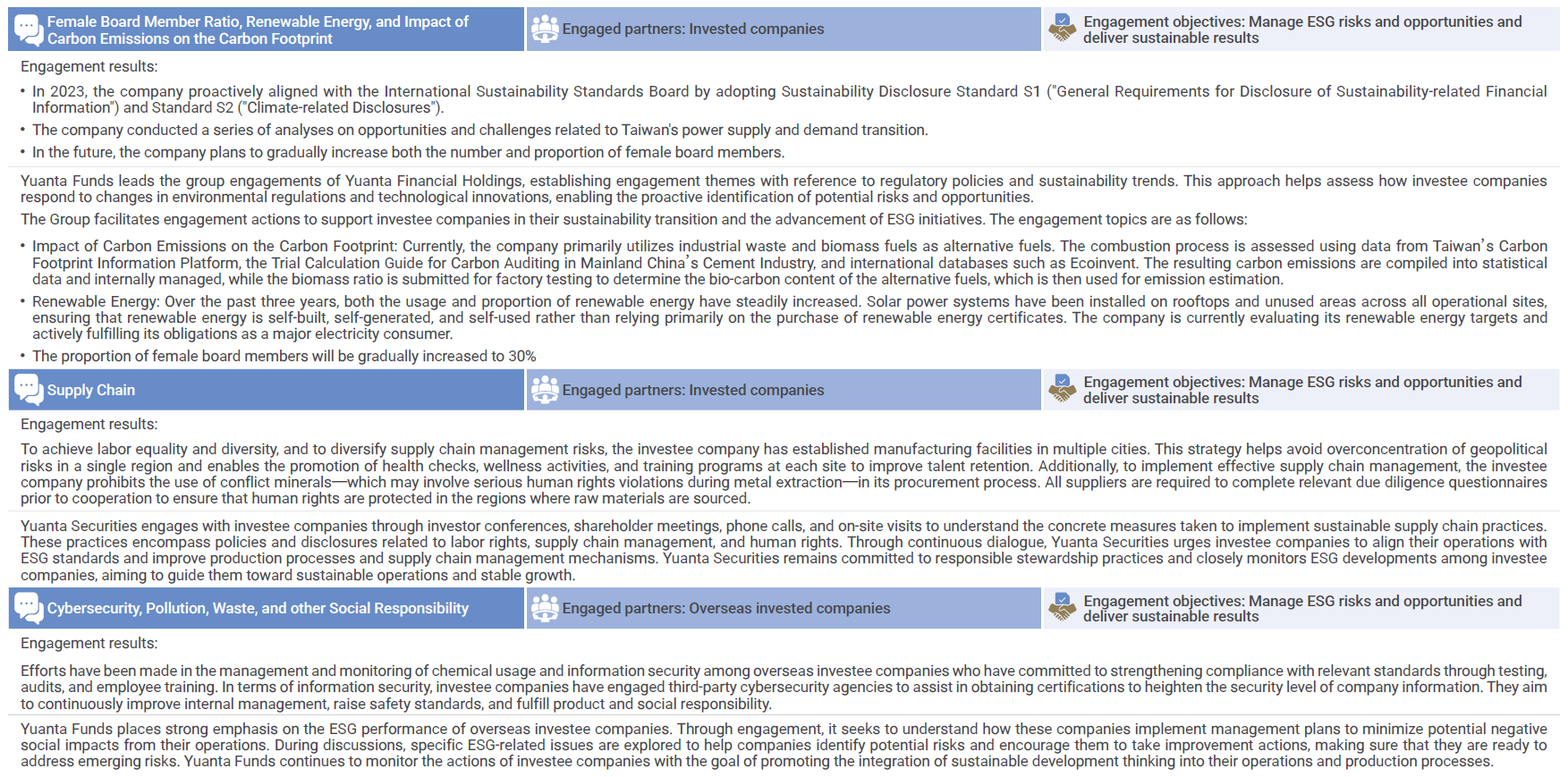

Yuanta Financial Holdings spares no effort in supporting the sustainable transformation of industries, continuously monitoring the actions and progress of invested companies in topics such as climate change, low-carbon transition, supply chain management, and corporate sustainability policies. We aim to promote concrete climate response actions and enhance climate resilience through interaction with investee companies. The Company has engaged with sixteen key invested companies in 2024. Industries involved include domestic semiconductors, electronic components, and textiles. Among them, five companies undertook specific improvement actions following engagement. These actions are: proactively piloting IFRS Sustainability Disclosure Standards S1 "General Requirements for Disclosure of Sustainability-related Financial Information" and S2 "Climate-related Disclosures"; actively responding to the International Union for Conservation of Nature (IUCN); establishing biodiversity conservation guidelines; and evaluating the setting of net-zero targets, serving as successful engagement cases for the Group. Every year, Yuanta Bank engages in ESG-focused dialogue and interaction with investee companies through questionnaires. These questionnaires primarily inquire whether the companies are continuously investing in energy saving or green energy-related sustainable equipment, engaging in nature and ecological conservation efforts, addressing the impact of their operations on biodiversity, and participating in positive-impact initiatives such as supply chain engagement—all of which are considered in investment decisions.

Yuanta Securities, Yuanta Bank, Yuanta Life, and Yuanta Funds have conducted engagements as institutional investors with invested companies and relevant partners to help them establish relevant response strategies, improvement plans, and future goals on major environmental issues. Examples of such engagements are as follows:

The Group also voluntarily adheres to the United Nations Principles for Responsible Investing, aiming to integrate ESG topics into investment decisions while enhancing the long term value of assets. This approach positions the Group as a stabilizing force in promoting sustainable development across industries and society as a whole. The Group compliance with the Responsible Banking Principles in 2024 is as follows:

| The Group compliance with the Responsible Banking Principles in 2024 | |

|---|---|

| Principle 1:We will incorporate ESG issues into investment analysis and decision-making processes. |

|

| Principle 2:We will be active owners and incorporate ESG issues into our ownership policies and practices. |

|

| Principle 3:We will seek appropriate disclosure on ESG issues by the entities in which we invest |

|

| Principle 4:We will promote acceptance and implementation of the Principles within the investment industry. |

|

| Principle 5:We will work together to enhance our effectiveness in implementing the Principles. |

|

| Principle 6:We will each report on our activities and progress towards implementing the Principles |

|

Yuanta Bank issued NT$1 billion in sustainability bonds on March 31, 2025 (Bond Code: G10833, Bond Short Name: P14元大銀 1). Through its wholly-owned subsidiary Yuanta Bank, Yuanta Financial Holdings invested in sustainability bonds approved by the Taipei Exchange. New investments for the year 2025 are detailed in the table below:

| Item | Bond Name | Bond Short Name | Code | Amount (NTD) |

|---|---|---|---|---|

| 1 | Mega Bank Green Bond | P14兆豐銀1 | G11849 | 1,000,000,000 |

| 2 | TSMC Green Bond | P11台積1A | B618CV | 100,000,000 |

| 3 | TSMC Green Bond | P11台積4B | B618D3 | 100,000,000 |

| 4 | TSMC Green Bond | P14台積2A | B618DZ | 300,000,000 |

| 5 | Land Bank of Taiwan Sustainability Bond | P10土銀1 | G12727 | 150,000,000 |

| 6 | Taipei Fubon Bank Social Bond | P10北富銀2 | G107C3 | 150,000,000 |

| 7 | Chunghwa Telecom Sustainability Bond | P14中華電1 | B9AG08 | 2,200,000,000 |

元大金控

元大金控