Effective auditing systems can not only protect against fraud, they can also provide early identification of potential internal and external risks, preventing or reducing the chance of crises arising. In this way, our auditing system helps the Group properly implement risk management and legal compliance, thus ensuring stronger corporate governance.

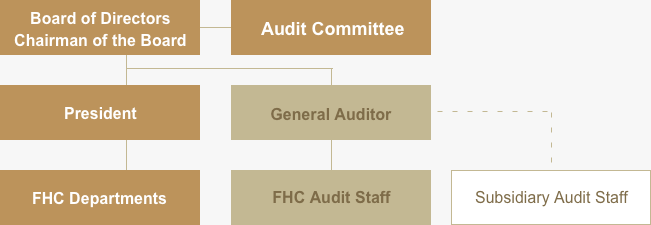

The Company has established a sound risk management policy, along with effective corporate governance and internal control mechanisms, and through independent internal auditing, conducts reviews and audits of operations. The Company’s Internal Auditing Department, under the board of directors, consists of an auditor-general who oversees the Company’s internal auditing activities and several other auditors. The auditor-general may, depending on business needs and in accordance with the “Yuanta Financial Holding Company Auditor-General’s Procedures for the Transfer of Internal Auditing Personnel,” transfer the auditing personnel of the subsidiaries to perform the internal auditing work of the Company and its subsidiaries, and shall be ultimately responsible for ensuring that the Company and its subsidiaries maintain an appropriate and effective internal auditing system.

The qualifications of internal auditing personnel must be in compliance with regulations set forth in the “Regulations Governing the Implementation of Internal Control and Audit Systems by Financial Holding Companies”. To raise their level of proficiency, each year auditing personnel participate in finance-related training courses arranged by an institution appointed by the government authority or classes arranged internally by the Company or its subsidiaries.

The Company has established internal auditing implementation methods. Appointments, removals, promotions, rewards and punishments, rotations, and appraisals of personnel in the Auditing Department shall be signed by the auditor-general and approved by the chairperson of the board of directors before processing. However, in the case of personnel of other management units, the Human Resources Department shall be consulted first before reporting to the president for agreement prior to signing to the chairperson of the board for approval.

The Company's Auditing Department has established guidelines entitled the “Yuanta Financial Holding Company Internal Auditing Implementation Methods”. These methods evaluate overall policies, Auditing Department structure and the qualifications of internal auditing personnel, chain of command, and track any deficiencies and relevant improvements with supplementary provisions. The established internal control system allows for close evaluation of the degree of effectiveness of implementation of the internal auditing function.

At the end of each year, the Auditing Department drafts an annual audit plan for the following year, and according to its policies, conducts a comprehensive business operations audit at least once a year and a specific project business operations audit once every six months. Additionally, based on the classification of our management structure, the Company conducts a specific project audit once every six months on the financial standing, risk management and legal compliance of each direct subsidiary. (Subsidiary companies in industries that require a different frequency of internal audits must act in accordance with those regulations).

The comprehensive operations audit that evaluates each area of business contains an audit report that covers the following:

- Auditing scope, overall assessment, financial status, capital adequacy, operational performance, asset quality, equity management, operational management of the board and audit committee, legal compliance, internal control, transactions with affiliated parties, control and internal management of each business operation, management of confidential customer data, data management, training employees in confidentiality matters, the status of the measures being used in the protection of consumer and investor rights, and self-evaluation methods.

- Items recommended for review or audit listed by the relevant financial authorities and by the Auditing Department, or those listed in the Statement of Internal Control System may at time prove to be inadequate. In these cases, the appropriate changes are made to strengthen the concerned items or make up for any deficiencies.

- Financial inspection organizations, accountants, internal auditing divisions, opinions raised by internal self-auditing, and the status of items mentioned in the internal control statement that are identified for improvement.

The Auditing Department tracks and re-examines any items aimed at strengthening any deficiencies in auditing functions of the financial review division, accountants, and Internal Auditing Department. A report is submitted to the board of directors and audit committee with the main items for continued review listed.

To ensure ongoing effectiveness of each subsidiary's internal control and auditing system, and to strengthen each subsidiary's internal auditing capabilities, the Company has established the “Yuanta Financial Holding Company Key Assessment Items in Affiliated Companies' Internal Auditing”. Each year, the head auditor must report to the board of directors on the results of their review of each subsidiary's internal auditing performance, and the results are sent to the board of directors of each subsidiary, for them to assess any necessary changes in personnel. Direct subsidiaries should refer to the Company’s relevant guidelines, evaluate the subsidiaries that have set up audit departments, and report to the Company’s Auditing Department.

元大金控

元大金控