To strengthen a finance-friendly environment, the Group has established and is implementing policies of financial inclusions. We tailor financial and non-financial inclusive financial products and services to underserved populations, such as establishing procedures to prevent over-indebtedness, training staff to avoid hard-sell tactics, providing easy and efficient communication channels, promoting market research and customer feedback, and strengthening partnerships and external initiatives. Moreover, our Board of Directors is the highest supervisory body for financial inclusion, and we are committed to protecting the rights and interests of the underprivileged.

On the other hand, besides making every effort to implement financial inclusion, Yuanta Group places great emphasis on the accuracy and appropriateness of descriptions and promotional materials with regard to insurance and financial products in an attempt to protect consumers from misleading claims about sustainability features. As a response to the "Guidelines for Financial Institutions on Greenwashing Prevention" issued by the Financial Supervisory Commission in May 2024, Yuanta Bank revised its "Insurance Product Promotional Material Review Checklist" in August 2024. The revised checklist is used to review product promotional documents provided by insurance companies, incorporating principles for sustainability-related statements as assessment criteria, in order to ensure consumer rights and further establish brand trust.

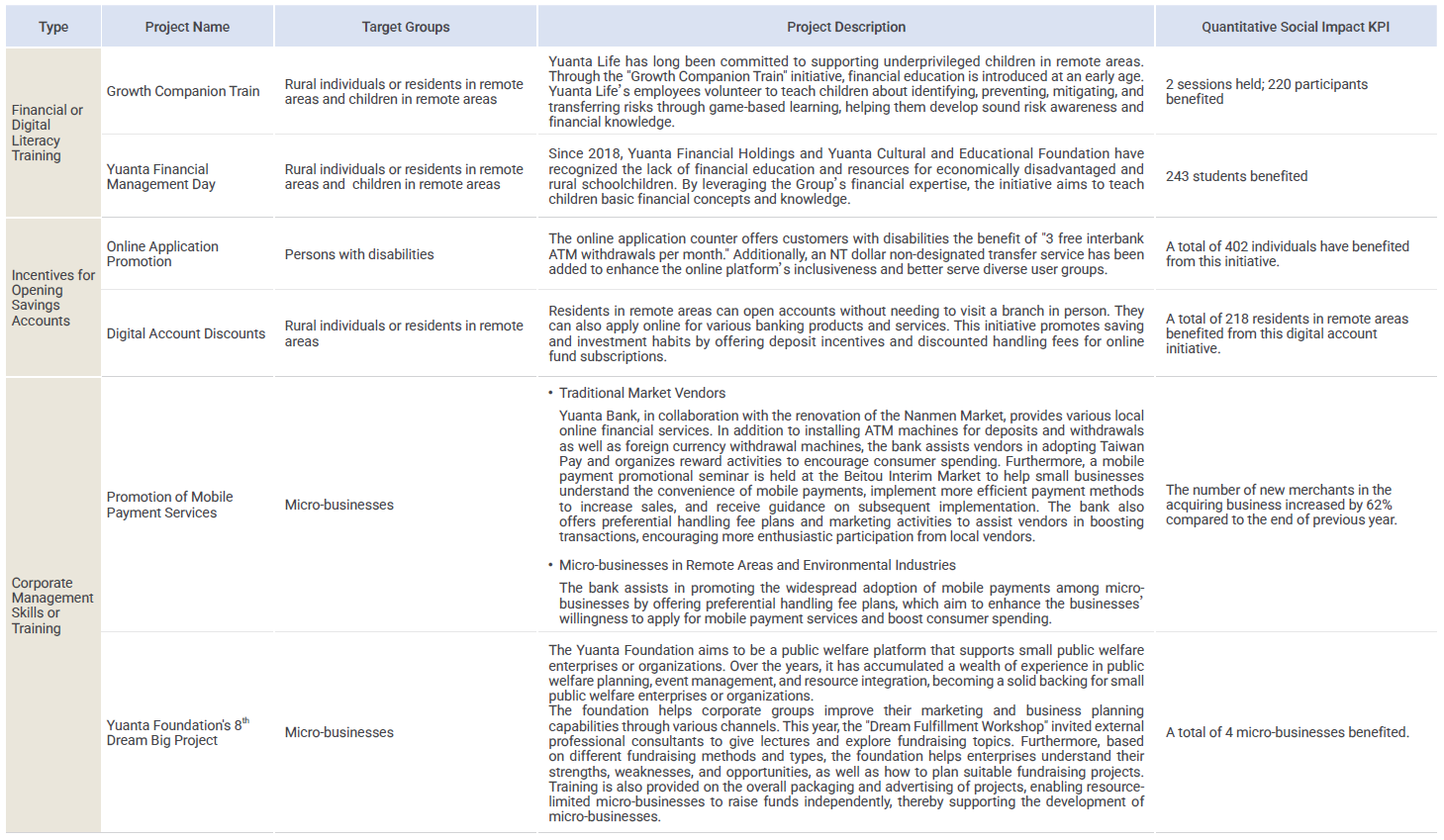

The Group implements the core concept of financial inclusion and observes issues derived from social trends. According to the observation, diversified products designed for underprivileged and low-income groups are developed, so that the customers can choose the most suitable plan at the moment for themselves. In this way, the Group is able to make impacts to solve social change issues from the standpoint of the financial industry.

Yuanta Bank and Yuanta Life offer insurance products such as "Quasi-Long-Term Care Insurance" and "Low-Cost Elderly Insurance" to provide affordable and accessible coverage protection for the public and plan for any personal risks.

Unit:NT$ thousand| Insurance Product | Number of Policies | Total Premiums | Intended Customer |

|---|---|---|---|

| Quasi-Long- Term Care | 92 | 4,833 |

|

| Low-Cost Elderly Insurance | 63 | 1,665 |

|

| Total | 156 | 6,498 | - |

Yuanta Bank's "Give Love, Give Warmth" online donation platform has been completely upgraded and revamped, providing people with the convenience of using any bank IC card and a card reader to connect with the network of love. The platform offers support and assistance to social welfare organizations. The cumulative number of donations made in 2024 by Internet bank transfer was over 37 with a donation amount of about NT$52,215, and 617 by credit card with a donation amount of NT$1.598 million.

As of December 31, 2024, the balance of loans outstanding qualified to programs designed to promote stable operation to 7,627 small and medium-sized enterprises was NT$227,387,936 (thousand dollars). The lending targets are SMEs that meet the criteria for SMEs forwarded by Taiwan’s Executive Yuan. We hope to provide funding to assist SMEs with cash flow and in maintaining working capital, and to help SMEs to stabilize their operations. Among the total loan amounts for small and medium-sized enterprises (SMEs), outstanding loans for micro-businesses, small businesses, and startup SMEs amount to NT$176.6 billion across 5,683 accounts. The remaining loan accounts and balances pertain to general SMEs, ensuring continuous support for the operational growth of SMEs and startup enterprises and promotion of economic development.

Unit:NT$ thousand| Lending Categories | 2023 | 2024 | ||||

|---|---|---|---|---|---|---|

| Loan Amount | Total Amount of Lending(Note) | Proportion of Total Lending(%) | Loan Amount | Total Amount of Lending(Note) | Proportion of Total Lending(%) | |

| SME/micro/small/small andmedium-sized start-ups Loans | 187,632,352 | 536,589,703 | 34.97 | 227,387,936 | 640,163,183 | 35.52 |

Note:Total Amount of Lending is defined as the total lending balance from Corporate Banking for the Yuanta Bank.

元大金控

元大金控